Trade Plan Breakdowns:

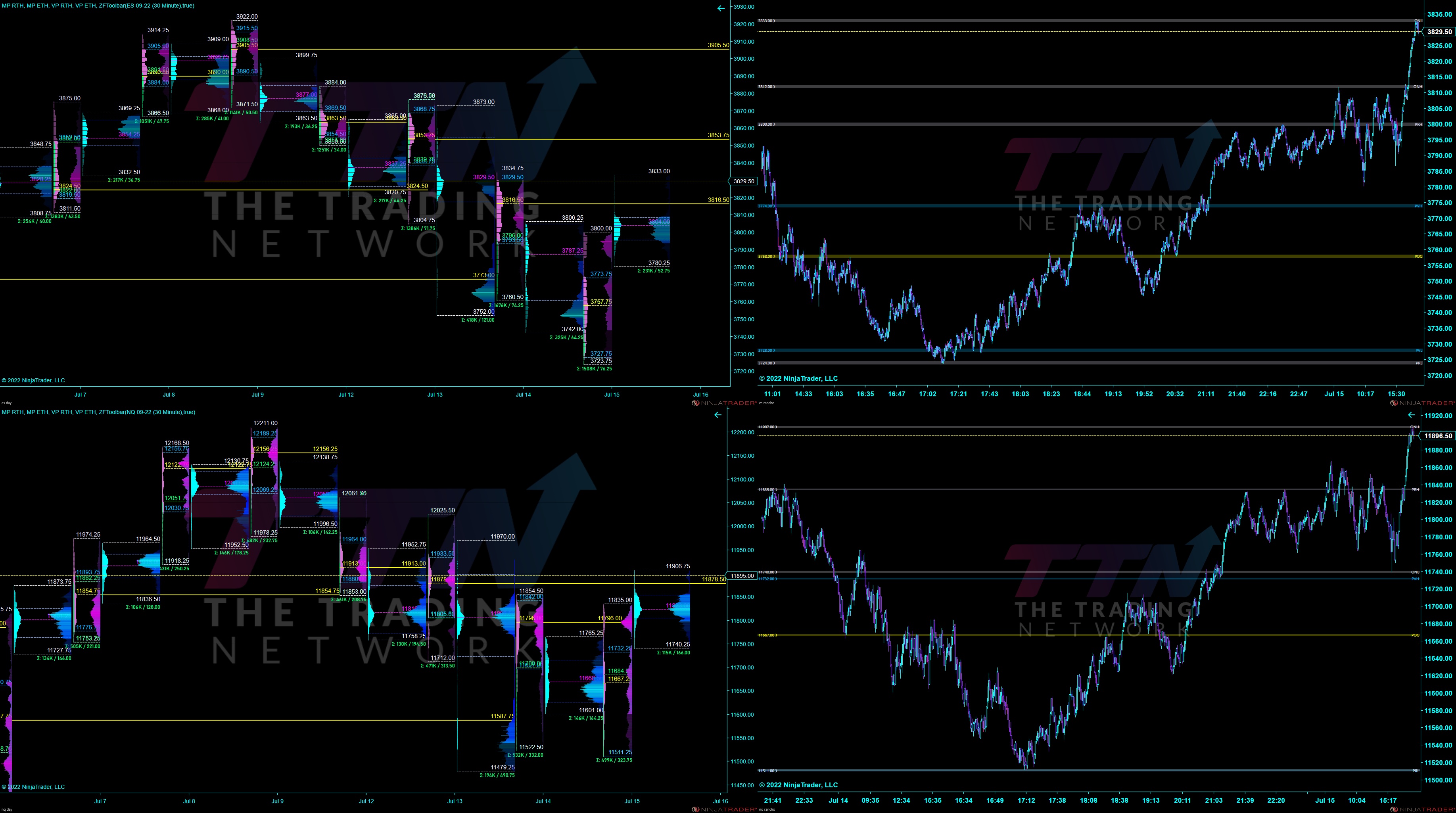

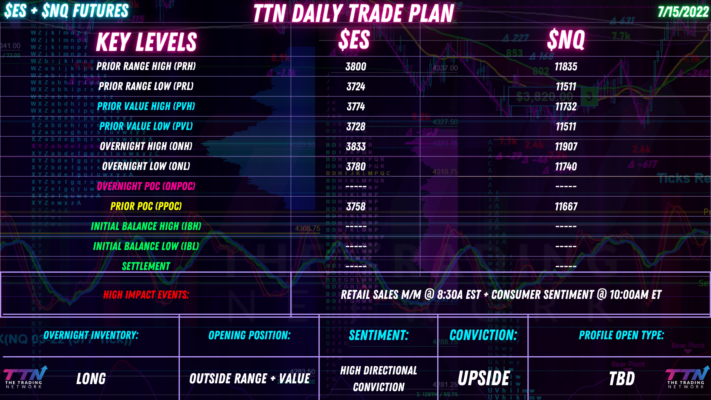

Overnight Inventory is 100% Long on ES and NQ this morning. At the time of writing, we are looking to open Outside Prior Range with GAP on both indices. When we open with this structure, it tells us that the settlement is shifted in one direction and that trending price action is the higher probability play.

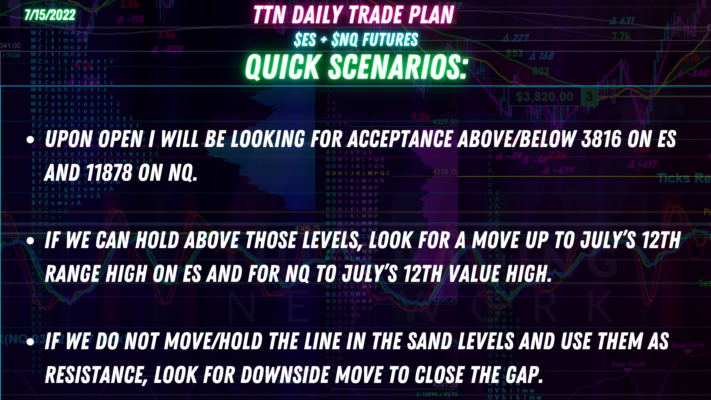

The most probable play is the Gap n Go. However we must keep an eye on both directions because price can reject the ONH.

With that said, today I will be looking at the July’s 13th naked POC as the line in the sand on ES and for NQ, July 14th naked POC.

If we can move and hold above this level, ES 3816 – NQ 11878 with acceptance, I’ll look for a move upwards to July 12th Range High on ES and for NQ to July 12th Value High and see reaction there.

If price fails to use the Line in the Sand Levels as support and uses them as resistance instead, then look for a move to close the GAP and see reaction there.

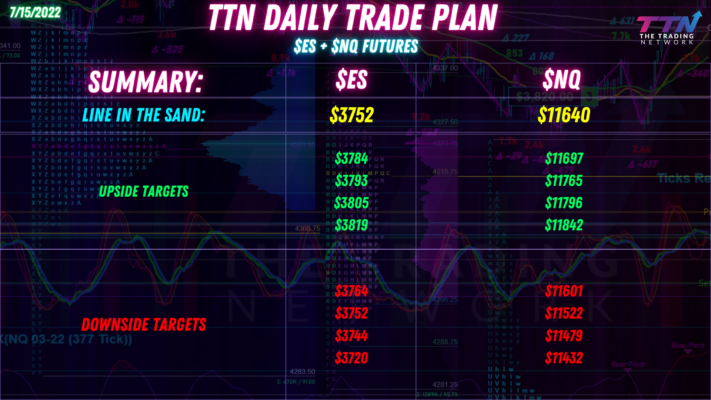

Summary: